Contents

With fees based on a mix of trader location, payment method, order size and market conditions, it’s difficult for users on the barebones platform to calculate what they might pay before they trade. One of Coinbase’s main features is its opportunity for users to earn crypto without actually buying it. Add that to its native wallet, which doesn’t actually require a Coinbase account, and tailored features for all levels of investors, and it outshines plenty of the best crypto exchanges. Crypto novices and beginners will enjoy Coinbase’s streamlined, sleek interface with minimal visual noise. And once investors feel more comfortable with cryptocurrency investing and exchanges, they can toggle to the advanced trading view to see candlestick graphs and order books for token-fiat pairs.

The Wallet is easy to use, secure and regulated to utilize US Dollars or other fiat currencies. Traders can store crypto safely without the hassle of managing private keys. Coinbase’s mobile application provides advanced trade security and enables two-factor authentication, security notifications, and fingerprint scanning with just a touch of a button. If you are a business looking for a way to invest your capital in cryptocurrency, Coinbase offers the below services.

More coins available from Coinbase

Selling Bitcoins directly to customers), but additional services were added along the way. Coinbase is one of the biggest cryptocurrency companies around, supporting over 100 countries, with more than 89 million customers around the world. It’s really hard to fault Coinbase, but we can’t give it 5 stars because of the fees. If you’re happy to pay for the convenience and security you can sign up to Coinbase here¹ to get a little bit of crypto for free.

Is Coinbase backed by a bank?

Cryptocurrency is not legal tender and is not backed by the government. Coinbase is not an FDIC-insured bank and cryptocurrency is not insured or guaranteed by or subject to the protections of the Federal Deposit Insurance Corporation (“FDIC”) or Securities Investor Protection Corporation (“SIPC”), and may lose value.

A user has the option of margin trading and can place market, limit, and stop orders with lower fees in commission. Also, it has several thousands of employees around the world. The custody service then goes through regular financial and security audits, which are conducted by external firms.

Rips you off when you purchase

As far as storage goes, there are numerous options for users to stash the keys to their crypto. In fact, Coinbase offers users three different crypto wallets. The company notes the insurance covers only losses related to Coinbase cybersecurity or employee theft; breaches to individual Coinbase accounts are not covered. The company also has noted in regulatory filings that its insurance coverage limits are below the total value of cryptocurrency it holds for customers . A novel way to “earn while you learn,” Coinbase provides a series of video classes and exams as a way to educate users about cryptocurrency trading and some of the cryptocurrencies on offer. And, by taking the classes, users can earn a few dollars worth of certain cryptocurrencies.

For example, if you trade less than $10,000 in the prior 30 days, you’ll pay 0.6 percent as a taker or 0.4 percent as a maker. Trade between $10,000 and $50,000 over the same time period and takers pay 0.4 percent, while makers pay 0.25 percent. A monthly coinbase exchange review trading volume between $50,000 and $100,000 would give takers a fee of 0.25 percent and makers 0.15 percent. The fees ultimately decline even further, but you’ll have to trade staggering amounts of cryptocurrency for it to make any difference.

What are the disadvantages of Coinbase?

High fees on simple trades and staking

There are a few areas where Coinbase's fees are expensive. Simple trades have high fees, especially for smaller transactions (below $200).

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. What the ¹ means – if you see this by a link, when you click through it may sometimes result in a payment to Nuts About Money. The information we provide is never impacted by these links, we are always impartial. We include them as it helps us keep the lights on and to help more people.

Gemini pays interest on nearly all supported currencies with rates up to 8.05%. It’s not clear, but the broker’s hefty fees for its basic tier probably have a lot to do with it. And that’s further corroborated by the broker’s good disclosure of fees for its Advanced Trade platform – where its costs are competitive with rivals’ and in some cases beat them.

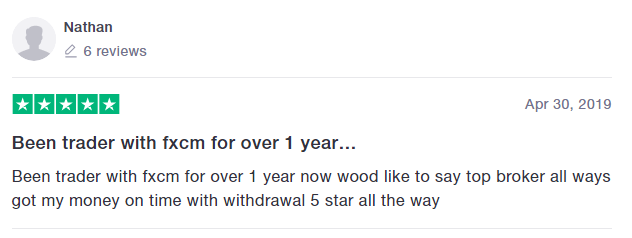

Coinbase also operates a phone support line, although from reader feedback we have received, it seems it’s hard to get someone to solve your problem there. On Trustpilot, the popular reviews website, they have a score of just 1.6 out of 5. However, a lot of the negative reviews are about verifying their identity and the fees rather than any particular issue with the Coinbase platform itself. And as they’re incredibly tight on security and safety of customers, you can be asked to verify your identity with documents providing it’s you.

Can’t login into my account

However, after you’ve bought a little and you want more, you can easily use their Coinbase Pro platform to get much cheaper fees (thank us later!). We like Coinbase and have used it ourselves when starting out. Crypto can be super confusing and intimidating to those new to the industry, and Coinbase makes everything super easy and super clear. There are however lots of 5 star reviews praising the platform for its ease of use.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Coinbase has several licenses to operate in the United States and other countries.

Where Coinbase falls short

If you’d prefer to stick to just crypto, though, see Kraken and eToro, and Binance.US also offers an enviable selection of cryptocurrencies. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers. We are an independent, advertising-supported comparison service.

All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy. Finally, review the details of the transaction and select send. You can contact Coinbase Support to immediately disable your account if you suspect your account has been compromised. The Customer Support phone number can be found on the email request form for live phone support. First, you enter your name, email, and a strong password as your login credentials.

While the number of cryptocurrencies listed on Coinbase is lower than what is offered by a couple of the best crypto exchange platforms, 180 currencies is more than most. This means that plenty of altcoins are available for trading. Clients can https://forex-reviews.org/ earn staking rewards on just a few cryptocurrencies right now, including Ethereum, Solana and Tezos. The exchange handles the technical side of things and the extra coins – or fractions of them – are added to your account on a set schedule.

Coinbase doesn’t have the best reputation when it comes to customer service and has actually scored an F from the Better Business Bureau because of it. When utilizing Coinbase Pro, trading fees can be anywhere from 0% to 0.5% per trade. Users can expect to pay a taker fee between 0.04% to 0.50% and a maker fee between 0% and 0.50%. Transaction and trading costs on Coinbase range from 0.5% to 4.5% depending on the cryptocurrency, transaction size and payment method. Both Coinbase and Coinbase Pro include FDIC insurance protection up to $250,000 per individual.

Coinbase has two-step verification, biometric fingerprint logins, crime insurance if Coinbase itself is breached , and stores 98% of users’ funds in offline storage. A lot of company reviews mention that Coinbase provides an intuitive platform that is easy to use. Comparing prices, checking balances, and executing buy-sell orders are just a few clicks away. Yes, you can keep your Bitcoins on Coinbase, however, I wouldn’t recommend it. It’s always best to keep your Bitcoin in a non-custodial wallet (i.e. a wallet where only you hold the private keys).

- Advanced trading offers more features, including charts, a live order book, and limit orders.

- For example, ACH transfer has higher limits than credit card purchases on Coinbase.

- If you are a small business investor looking to invest your money into cryptocurrency, then Coinbase is ideal.

- Coinbase has an enhanced newsfeed, which is comprehensive and updated frequently.

- Transaction costs are higher compared to other cryptocurrency platforms.

- However, Gemini research and vet the coins a bit more rigorously, making sure they are legitimate businesses and projects operating in good faith.

The first is the requirement for a safe location to keep digital assets in our organization. The second is the requirement for an efficient method of buying and selling digital assets. The third is the requirement for a simple method of accepting and making use of digital assets as payment. We use Coinbase in the organization for cryptocurrency exchanges and other related transactions. We have a not-so-unique business need, along with many other SAAS companies, to accept many forms of payment for our services.

Thanks to those benefits and its topnotch security, Coinbase is one of the largest cryptocurrency exchanges in the world. Read our full Coinbase review to see if it’s the exchange for you. If you leave your crypto assets in online crypto wallets or third-party platforms, there are chances that they might get hacked or might be stolen. Coinbase has strict security controls around its platform and offers commitment for cold storage. 99% of the client’s coins and cryptocurrency funds are stored in this offline wallet storage, which means these coins remain in offline wallet storage at all times. This way, the trader’s cryptos are safe and do not get hacked or stolen.

But with its wide range of products and its wallet’s dApp integration, that ceiling may be pretty high for the average, low-volume investor. Advanced traders can use Coinbase Pro to see even more data and execute trades with real-time analytics. Plus, Coinbase Pro operates with slightly lower maker-taker fees than Coinbase’s standard trading platform. With Coinbase Pro, expert traders can manage orders and view real-time market data.

You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. The cryptocurrency marketplace is evolving quickly with new competitors. You also have the option to manage your cryptocurrency without a major centralized exchange like Coinbase. Major competitors to Coinbase include Gemini, Binance, KuCoin, Kraken, and many others. The rewards section where you can earn free cryptocurrency for taking short lessons. Coinbase also suffers from a problem that seems to be plaguing many industry competitors.

Нет Ответов